💡AS OF January, 2026

Elon Musk’s SpaceX has spent over two decades as one of the most valuable private companies on Earth — a secretive powerhouse revolutionizing space travel with reusable rockets, dominating satellite internet through Starlink, and securing massive NASA and commercial contracts. For years, Musk resisted taking it public, preferring the flexibility of private ownership. But 2026 looks set to change that.

Elon Musk’s SpaceX has spent over two decades as one of the most valuable private companies on Earth — a secretive powerhouse revolutionizing space travel with reusable rockets, dominating satellite internet through Starlink, and securing massive NASA and commercial contracts. For years, Musk resisted taking it public, preferring the flexibility of private ownership. But 2026 looks set to change that.

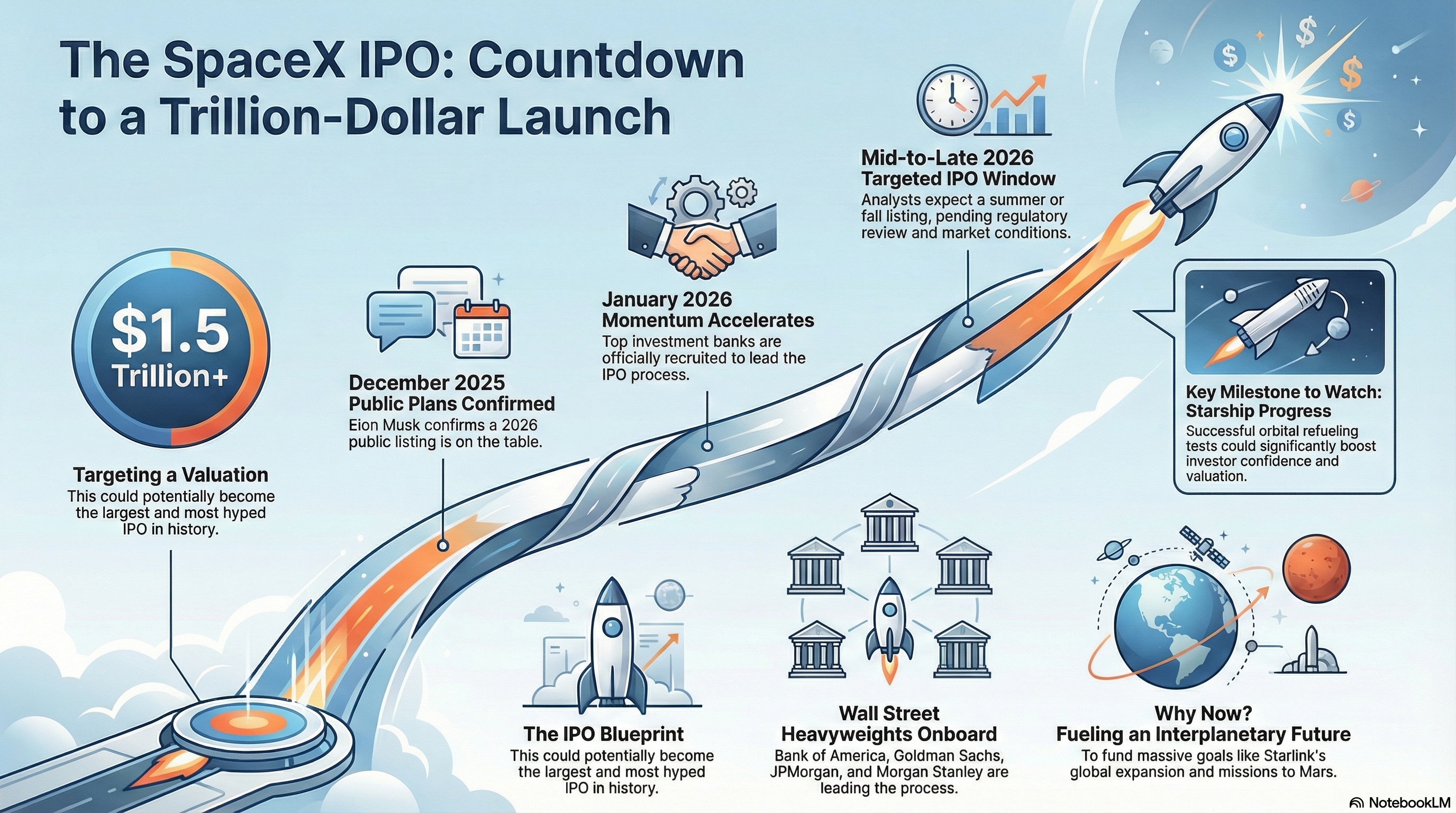

Recent reports from major outlets like Reuters, Financial Times, Bloomberg, Forbes, and The Guardian confirm SpaceX is actively moving toward an initial public offering (IPO) later this year. This could become the largest IPO ever, potentially eclipsing even the biggest tech listings in scale and hype.

The Latest Developments Link to heading

-

Banks on Board

SpaceX is lining up four Wall Street heavyweights — Bank of America, Goldman Sachs, JPMorgan, and Morgan Stanley — to lead the IPO process. These firms are already involved in recent private share sales valuing SpaceX around $800 billion, but the public debut could target a much higher $1.5 trillion valuation (or more, depending on market appetite). -

Timeline Momentum

- Elon Musk confirmed in December 2025 that a 2026 public listing was on the table.

- Momentum accelerated in January 2026 with underwriter recruitment.

- Some sources (including reports tied to Musk’s ambitions) suggest an aggressive push for completion as early as July 2026.

- Broader analyst consensus leans toward mid-to-late 2026 (summer or fall), though it could slip into early 2027 depending on market conditions, regulatory reviews, and execution of milestones like Starship orbital refueling tests (targeted for mid-2026).

-

Why Now?

Musk reportedly wants massive capital to fuel next-level goals: expanding Starlink to global broadband dominance, orbital AI data centers, full Starship reusability for Mars missions, and more. Starlink’s revenue growth and SpaceX’s launch cadence (often 60%+ of global orbital activity) provide strong fundamentals.

Key Milestones to Watch Link to heading

- SEC Filing (S-1): Expect a confidential submission in the coming months — this kicks off the formal review process.

- Starship Progress: Successful ship-to-ship propellant transfer demos (targeted as early as mid-2026) could boost valuation and investor confidence.

- Public Hype Building: High-profile moments like MrBeast’s recent Starfactory tour video (reaching hundreds of millions) feel like soft marketing ahead of the listing.

- No Official Confirmation Yet: Musk hasn’t tweeted directly about the IPO timeline recently, but the pieces are aligning fast.

What It Means for Investors Link to heading

SpaceX isn’t publicly tradable yet — shares are limited to accredited investors via secondary markets or tender offers at sky-high private prices. A successful IPO would open the door for retail access, likely on a major exchange like NYSE or Nasdaq.

This isn’t just another tech IPO. It’s a bet on humanity’s multi-planetary future, backed by real revenue (Starlink subscriptions, launch contracts) and unprecedented ambition. If it hits the rumored scale, it could dwarf past blockbusters and reshape space investing.

Of course, Musk’s plans can pivot quickly — regulatory hurdles, market volatility, or new priorities could shift things. For now, though, the trajectory is clear: 2026 is shaping up as the year SpaceX goes from private rocket pioneer to public market giant.